Note: This article is based on the talk given at the Chicago council on Global Affairs titled, “Global markets : The next champions of the global economy” by Ruchir Sharma.

I have come across some very fascinating ideas in the above mentioned talk. In this article, I have tried to summarise the ideas, to the best of my ability & with some basic research, I have tried to look at the economic prospect of India with regards to the said rules :

– Economic forecasting is very important, but long-term economic forecasting has zero practical value. The longer the forecast, the higher the probability that the forecast will be wrong, because new events might occur along the way which might alter the economic trajectory of nation.

Some rules based on which the next big economic success of a nation would be determined (each rule has some exception) :

1. Circle of Life :

- Politics of a nation directly impacts it’s economic policies.

- For emerging markets, there’s a law of diminishing returns with respect to economic progress for an elected political leader staying in power : Longer a political leader stays in power, lesser will be the country’s economic performance.

- For emerging markets, there’s a very high probability that economic performance of the nation under a democratically elected leader will be lesser in the 2nd term in comparison to the 1st term.

- Most of the emerging markets would never graduate to developed economies, because most of them get stuck in the “crisis-economic reforms-revival-complacency” cycle. Most of the emerging markets, having a booming decade & then a decade a downward slump & this is the primary reason behind why an emerging nation, might never graduate to a developed nation.

- For developed nations, the above rule of diminishing returns is not applicable, because institutions (judiciary, central bank , … etc) in developed nations are much stronger than emerging nations & hence, election of a particular leader does not determines the economic trajectory of the market. Such nations can also be called as “post-democratic nations” in this context.

Note : With the above theory in mind, let’s look at the state of Indian economy 🇮🇳📊 from the year 2002-2012:

Growth rate of India for respective years from 2001-13 (Based on data 📊 from Government of India) :

Growth rate of Indian economy

As you can clearly see that Indian economy’s growth rate went from 3.84% in FY 2002-2003 to 9.32% in FY 9.32% in FY 2007-2008 & the animal spirits of Indian economy were fully unleashed until 2008’s financial crisis & it’s understandable that economic growth would have fallen in FY 2008-09 to 6.72%, because of global recession, but Indian economy was hit less by the global financial crisis in comparison to excessive 20% YoY credit growth rate from 2006-11, which has finally led India to near-stagnation/recession like condition in 2019 (which shows the boom & bust “crisis-economic reforms-revival-complacency” cycle of India).

2. Contrarian rule :

- When journalists are excited about an economic trend, then it is most probably the case that the trend will exhaust itself. Since 1980, every time when a country’s economic position has been portrayed in a positive way in the Time Magazine, then there’s a high probability that the country would face economic recession within in the next 5 years.

e.g. An example of the above rule would be Japan. In the 1992 American elections, Japan Bashing [1][2] was very common, while it was portrayed in the American media as the land of ever-rising sun, but around the same time, Japan also entered 10-year long recession also called as “The lost decade”.

- It is important to remember that economic trends do not last forever, hence extrapolating the economic trends do not make any sense.

3. Good & bad billionaires :

- Income inequality is also a very important factor for understanding the rise & fall of a nation’s economic progress. If income inequality of a nation becomes very large, then there’s large probability that there will be a backlash which could hit the wealth creation process of a nation.

- Good billionaires : Generally, the wealth created in sectors like technology, manufacturing, pharmaceuticals amongst other sectors is often celebrated as success across the class division, for a particular sector.

- Bad billionaires : There’s often a backlash against wealth created in the sectors which would require connections in the government & which might also involve crony capitalism. It includes sectors like Mining, Real state, Oil & gas & even sectors like Telecom in some countries (like Mexico).

- The probability of a rich person assuming a top office in a nation with high income inequality & severe crony capitalism is almost 0%, because of resentment & backlash against wealth creators. This would be true for Russia & Mexico.

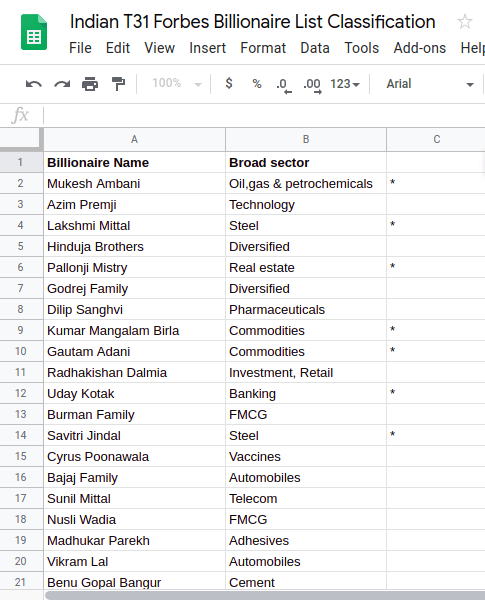

- Once again, let’s look at India with this regard, because India is one of the countries with the highest Income inequality. Let’s give a look at the top 31 Indian billionaires according to Forbes :

Out of the list of top 31 Indian billionaires, only 8 billionaires have their wealth tied to sectors which requires large governmental connections (mostly from sectors like steel, oil & gas, commodities, banking, … etc), which explains why despite having a very large income inequality, there’s not an absolute backlash & resentment against the wealth creation process in India, but the resentment against the super-rich is still alive in India, primarily, because of the fact that prior to India’s 1991 economic reforms (a notorious era from 1947-1990, also know as the “License Raj”), much of India’s private sector wealth was created through crony capitalism & it’s memory is still alive in a fairly large population of India.

4. Cities :

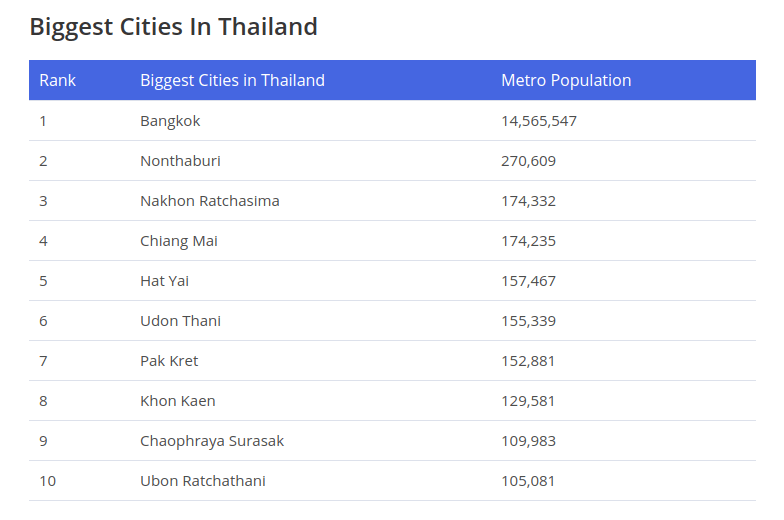

- Another fault line is created in the countries, where the ratio of population of most populous city & the second most populous city is higher than 3:1 ratio. One such example is Thailand, where there’s a huge resentment in smaller provinces against Bangkok. Similar fault line, lies in France, where population gap between Paris & Léon is 6:1 & England, where population gap between London & Manchester is 4:1.

- While this factor is applicable only to mostly urbanised (& industrialised) nations, but in India, the gap between the most populous & the 2nd most populous city is 1.18:1 . The real fault line in India lies in the “urban versus rural” divide. According to 2011 census of India, almost 70% of Indians lived in rural areas, whereas by 2030, almost 50% of Indians will live in cities, which once again will bridge the gap in the urban vs rural fault line.

5. Kiss of debt :

- This is the most important factor & the single most important predictor of economic slowdown of a nation.

- When a country takes too much debt in a 5 year period, then there’s a 100% chance of economic slowdown in the next five years & 70% chance of economic recession.

e.g. We will look at two examples from Asia :

- There’s no country in the history of the world that has taken more debt in a shorter period of time, than China since 2008’s financial crisis. In fact, as of 2018, China’s debt has ballooned to $34 Trillion. Much of the debt is largely internal [1][2][3][4] & it is passed around, but because of this huge piling of debt, there’s a high certainty that China will face recession in the near future.

- Since, India’s worst growth recession is currently unfolding, it’s important to understand, how did Indian economy reach here & the primary reason behind it is the excessive credit growth from 2006-11, which has finally starved the Indian banking system due to the NPA mess, but the credit given during that period wasn’t necessarily given with commercial interests of the largely governmental controlled banking system in mind, rather there was too much political interference in the loan giving process, which might have been in conflict of the commercial interest of the banks.

The three D’s for economic growth

(A) Demographics : Economic growth of a nation is dependent upon two important factors :

(i) Number of people participating the labour force.

(ii) Productivity of the labour force.

The working age population has fallen down from ~2% from 1950-2008 to ~1% from 2008 on wards. This also explains why the global economy’s growth from has fallen from ~4% (from post-WW2 period to 2008) to ~2% (post 2008).

Demographics also explains why United States has had more economic success in per-capita terms w.r.t. EU & Japan, despite the fact that U.S. , E.U. & Japan has grown at the same pace since 2005 & Immigration is the main reason behind it.

(B) Debt or fear of debt : 2008’s financial crisis has induced a fear of risk taking as well as the fear of giving debt & this will have significant impact on the health of global.economy.

(C) Deglobalisation : Globalisation has had major impact on growing the global economy at a much faster pace. But the process of globalisation, has hit major roadblocks due to multiple reasons & once again it would effect, the growth of global economy

- Now coming to India, India is going to benefit very much from it’s demographic dividend, only if the labour productivity increases, but there are major issues with it [1][2]. Coming to debt, India’s NPA mess, is still haunting the Indian banks & it will still have some further complications in India. As of 2018, India had held the top spot when it came to “foreign national remittances” at $80B & deglobalisation might really affect the remittances. So all in all, the future of India’s economy looks “good”, if it’s able to clear the massive debt problem in the Indian banking system & also make major economic reforms, which would allow growth of the Indian MSME sector.

Books written by Ruchir Sharma :

1. The Rise & fall of nations : The forces of change in a post-crisis world

2. Break-out nations : In pursuit of the next economic miracles